Monthly EMI: ₹0

Principal Amount: ₹0

Total Interest: ₹0

Total Amount: ₹0

Are you planning to buy your dream home, a new car, or need funds for a personal milestone? Taking a loan is a common solution, but managing repayments can be tricky. That’s where an EMI Calculator comes in—a powerful tool that helps you plan your finances and avoid surprises. Let’s explore how it works, why it’s useful, and how you can use it to make smarter loan decisions.

What is an EMI?

EMI stands for Equated Monthly Installment. It is the fixed amount you pay every month to your bank or lender until your loan is fully repaid. Each EMI includes both the principal (the original loan amount) and the interest (the cost of borrowing)

What is an EMI Calculator?

An EMI calculator is an online tool that quickly estimates your monthly loan payments. By entering your loan amount, interest rate, and tenure, you get an instant result.

Why Use an EMI Calculator?

There are many EMI calculators online. Using the right one helps you:

- Get accurate EMI amounts

- Avoid manual calculation errors

- Plan your budget: Know exactly how much you’ll pay each month.

- Compare loan options: Try different loan amounts, rates, and tenures to find the best fit.

- Avoid financial stress: Make sure your EMI fits comfortably within your monthly income

Key Factors That Impact Your EMI

Before applying for any loan, consider these things:

- Loan Tenure: A longer tenure means lower EMIs, but you pay more interest overall. A shorter tenure means higher EMIs but lower total interest.

- Interest Rate: A lower interest rate reduces your EMI. Always compare offers before finalizing.

- Loan Amount: Bigger loan = bigger EMI. Choose the amount wisely based on your income.

How an Online EMI Calculator Helps

With over 107 million credit accounts and rising, an EMI calculator is your best friend. Here’s why:

- Helps you plan your finances better.

- Ensures your EMI fits within your income.

- Saves time by giving instant results.

- Avoids any chances of miscalculation.

- Works differently for different loans (like home vs personal loan).

How Does an EMI Calculator Work?

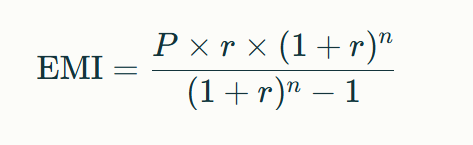

EMI Formula Used

The standard formula to calculate EMI is:

EMI = [P × R × (1+R)^N] / [(1+R)^N – 1]

Where:

- P = Principal loan amount

- R = Monthly interest rate (Annual rate ÷ 12 ÷ 100)

- N = Loan tenure in months

Example:

If you borrow ₹5,00,000 at 11% interest for 3 years (36 months), your EMI will be around ₹16,416 per month

Types of EMI Calculators on CalcByte

CalcByte offers calculators for all major loans:

Home Loan EMI Calculator

For big-ticket, long-term loans like home loans. Enter your loan amount, interest rate, and tenure to get your EMI instantly.

Car Loan EMI Calculator

Helps you plan EMIs for your vehicle loan. Avoid default by knowing what you can afford.

Personal Loan EMI Calculator

Useful for short-term needs like travel, medical, wedding, etc. Since personal loans have higher interest rates, knowing your EMI helps avoid over-borrowing.

Education Loan EMI Calculator

Ideal for financing higher education. Enter loan details and get EMI post the moratorium period.

Loan Against Property EMI Calculator

Use this for loans backed by residential, commercial, or land property. It ensures you don’t overstretch your repayment ability.

How to Use an EMI Calculator: Step-by-Step

Very simple steps:

- Enter the Loan Amount: The total money you want to borrow.

- Enter the Interest Rate: The annual rate charged by the lender.

- Enter the Loan Tenure: The number of months or years for repayment.

- Click Calculate: The tool instantly shows your monthly EMI, total interest, and total repayment amount

- Get your EMI instantly—no wait, no math.

Benefits of Using CalcBytes’s EMI Calculator

- Free to use anytime

- Instant and accurate results

- Saves time and effort: No need for manual calculations.

- Available for all major loan types

- Reduces Errors: Provides accurate results instantly.

- Empowers Decisions: Helps you choose the right loan amount and tenure for your needs.

Conclusion

An EMI calculator is a simple yet powerful tool for anyone considering a loan. It gives you clarity, helps you plan your finances, and ensures you make informed decisions. Whether you’re buying a home, a car, or need funds for personal reasons, using an EMI calculator is the smart first step to a stress-free loan experience

Frequently Asked Questions

1. What types of loans does the EMI calculator support?

Home loans, car loans, education loans, personal loans, and more.

2. What is a debt-to-income ratio?

It’s the portion of your income that goes toward repaying debt. Keep it below 50% for better loan approval chances.

3. What does an EMI include?

Every EMI includes principal + interest.

4. What if I miss an EMI?

You may face late fees, a lower credit score, and in some cases, the lender can take legal action or repossess your asset (like a car or home)

5. What is EMI?

EMI is the Equated Monthly Installment you pay to the lender every month until your loan is fully repaid. It includes both principal and interest

6. Why is an EMI calculator useful?

It helps you plan your finances, compare loan options, and ensure you can afford the EMI before taking a loan

7. Can I change my EMI amount?

You can change your EMI by adjusting the loan amount, interest rate, or tenure. Use the calculator to see how changes affect your monthly payment

8. Is the EMI amount fixed?

Yes, the EMI amount stays the same throughout the loan term unless you prepay or change loan terms