Monthly EMI: ₹0

Principal Amount: ₹0

Total Interest: ₹0

Total Amount: ₹0

Buying your dream home is a big milestone. But for most people, purchasing a house means taking a home loan. One of the most important things to understand before taking a loan is how much you will need to pay every month—this is where a Home Loan EMI Calculator becomes your best friend. In this article, we’ll explain what a Home Loan EMI Calculator is, how it works, why it’s useful, and answer some common questions in simple language.

What is a Home Loan EMI?

EMI stands for Equated Monthly Installment. It is the fixed amount you pay every month to your lender (like a bank or housing finance company) until your home loan is fully paid off. The EMI includes both the principal (the amount you borrowed) and the interest (the cost of borrowing that money).

How is Home Loan EMI Calculated?

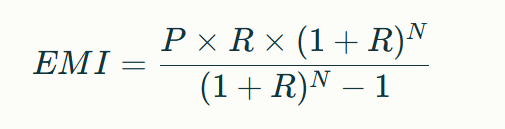

The EMI is calculated using a specific mathematical formula:

EMI = \frac{P \times R \times (1+R)^N}{(1+R)^N-1}

Where:

- P = Principal loan amount (the amount you borrow)

- R = Monthly interest rate (annual rate divided by 12 and then by 100)

- N = Loan tenure in months (number of months over which you repay the loan)

Example:

If you take a loan of ₹10,00,000 at an annual interest rate of 7.2% for 10 years (120 months),

- Monthly interest rate (R) = 7.2/12/100 = 0.006

- Using the formula, your EMI will be approximately ₹11,714.

What is a Home Loan EMI Calculator?

A Home Loan EMI Calculator is an online tool that helps you find out how much EMI you will need to pay for a particular loan amount, interest rate, and tenure. You simply enter:

- The loan amount you want

- The interest rate offered by the lender

- The number of months or years you want to repay the loan

The calculator instantly shows you your monthly EMI, total interest payable, and total payment (principal + interest).

Benefits of Using a Home Loan EMI Calculator

1. Quick and Easy Calculations

No need for complex math or manual calculations. Just enter the values, and get your EMI in seconds.

2. Accurate Financial Planning

Knowing your EMI helps you plan your monthly budget and ensures you don’t take a loan you can’t afford.

3. Compare Different Loan Options

You can change the loan amount, tenure, or interest rate to see how your EMI changes. This helps you pick the best loan offer.

4. Breakdown of Charges

Many calculators also show you the total interest you’ll pay and the total amount you’ll repay over the loan period.

5. Accessible Anywhere

Most EMI calculators are available online and can be used on your computer or mobile phone anytime.

How to Use a Home Loan EMI Calculator?

Step-by-Step Guide:

- Enter the loan amount you want to borrow.

- Enter the interest rate offered by the lender.

- Enter the loan tenure (in months or years).

- Click ‘Calculate’ or similar button.

- Instantly see your monthly EMI, total interest, and total payment.

You can adjust the values as many times as you want to find an EMI that fits your budget.

Factors That Affect Your Home Loan EMI

- Loan Amount: Higher loan amount means higher EMI.

- Interest Rate: Higher interest rate increases your EMI.

- Loan Tenure: Longer tenure means lower EMI, but you pay more interest overall.

- Down Payment: Higher down payment reduces the loan amount and your EMI.

Why Should You Calculate Your EMI Before Taking a Home Loan?

- Avoid Surprises: Know exactly how much you need to pay every month.

- Better Budgeting: Plan your finances and avoid missing payments.

- Choose the Right Loan: Compare different loan offers and pick the one that suits you best.

- Negotiate Better: Knowing your EMI helps you negotiate better terms with the lender.

Conclusion

A Home Loan EMI Calculator is a simple yet powerful tool that helps you plan your home purchase wisely. It saves you time, gives you accurate information, and helps you make better financial decisions. Before you apply for a home loan, always use an EMI calculator to know your monthly commitment and choose the best loan for your needs.

Remember, buying a home is a big step—make sure your finances are ready for it!

Frequently Asked Questions

1. What details do I need to use a Home Loan EMI Calculator?

You need three details: the loan amount, interest rate, and loan tenure (in months or years).

2. Does the EMI remain the same throughout the loan tenure?

Yes, usually the EMI remains the same if you have a fixed interest rate. If your loan has a floating interest rate, the EMI may change if the rate changes.

3. Can I change my EMI date?

Yes, many banks allow you to change your EMI deduction date by contacting customer service or visiting a branch.

4. What happens if I prepay my home loan?

Prepaying your loan (paying extra before the tenure ends) can reduce your outstanding principal and the total interest you pay. Some lenders may charge a prepayment fee.

5. Is the EMI calculator result always accurate?

The calculator gives a close estimate. However, actual EMI may vary slightly due to processing fees or other charges by the lender.

6. Why is the EMI higher for shorter tenure?

A shorter tenure means you have less time to repay the loan, so the monthly amount is higher. However, you pay less total interest.

7. Can I use the EMI calculator for other types of loans?

Yes, you can use similar calculators for personal loans, car loans, etc., but always check if the calculator is designed for your loan type.